Growth 100 Portfolio

Compak creates specialty equity portfolios with the goal of meeting a client’s specific growth/capital appreciation need. The growth portfolio may be comprised of global equities, ETFs, and cash.

Portfolio Characteristics:

Portfolio Constituents: Primarily equities

Risk Profile: Very Aggressive

Benchmark: 100% S&P 500

Return Goal: Capital Appreciation

Security Selection Method: Fundamental & Technical screening

Equity Selection for Growth 100 Portfolio

Investment Universe: Global equities with at least 50% in US equities

Quantitative Screening applied on the investment universe

Fundamental Metrics: valuations, balance sheet structure, profitability

- Fundamental Metrics: Based on valuations, balance sheet structure, profitability, growth prospects

- Momentum oriented technical indicators

- Fundamental score & Momentum score = Final score

Selling Strategy

- Low internal scoring

- Target price has been reached

- Equity valuations

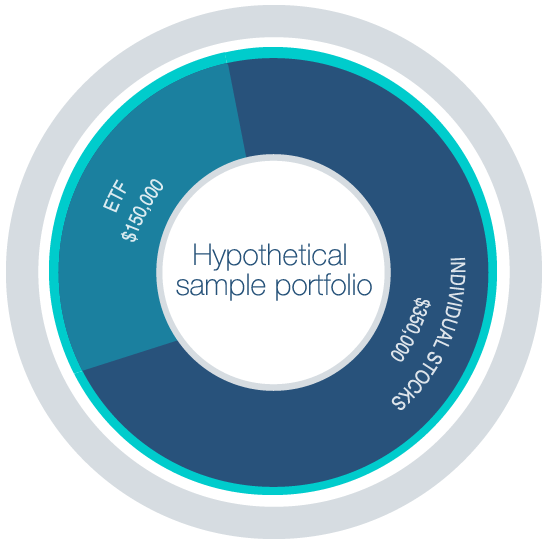

50% – 100% in Equities

- 50% – 100% in Individual stocks

- 0% – 50% in ETFs

0% – 50% in Cash

Based on Compak proprietary model, the equity exposure could range between 50% to 100%. The hypothetical sample portfolio is only indicative of the type of securities that may be purchased. The graph and allocations are examples of what a portfolio might look like, not a description of a fixed or static allocation, as Compak will actively change the portfolio’s allocation. Your actual portfolio will be significantly different from the hypothetical sample portfolio.

Dividend Income 60-40 Portfolio

Compak creates specialty equity portfolios with the goal of meeting a client’s specific growth and/or income need. The Dividend Income 60-40 Portfolio may be comprised of dividend paying equities, ETFs, corporate bonds, emerging market bonds, and municipal bonds.

Selection Characteristics:

- Low dividend payout

- Solid balance sheet

- Strong cash generation

- Stable dividend distribution policy

- Attractive growth prospect

Investment Universe: Global equities with at least 50% in US equities

Equity selection goal is to:

- Maximize dividend yield

- Lower the risk of dividend reduction

Based on Compak proprietary model, the equity exposure could range between 40$ – 60%.

- A client with higher tax bracket may require a larger allocation to Municipal Bonds.

- A client with a goal to have potential for portfolio appreciation in addition to income, may be appropriate for greater equity exposure.

- A client seeking greater current income and can accept higher risk, may require a higher investment in high yield corporate and municipal bonds.

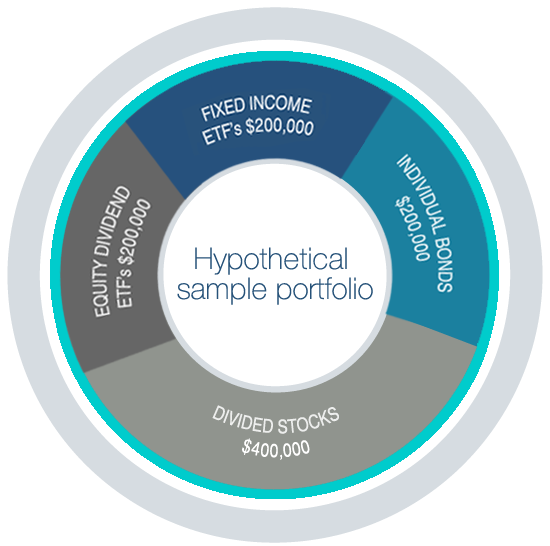

40% – 60% in Equities

- 20% – 60% in Individual dividend stocks

- 0% – 20% in ETFs

40% – 50% in Fixed Income

- 5% – 30% in Selected Bonds

- 5% – 30% in ETFs (Mainly corporate bonds)

0% – 20% in Cash

Risk profile, income goal, and need for appreciation determines the percentage of allocation to equities and fixed income. The graph and allocations are examples of what a portfolio might look like, not a description of a fixed or static allocation, as Compak will actively change the portfolio’s allocation. Your actual portfolio will be significantly different from the hypothetical sample portfolio.

Is your portfolio properly allocated? Click Here to start the process for your optimized sample allocation.

Money Management

Compak Research Advantage