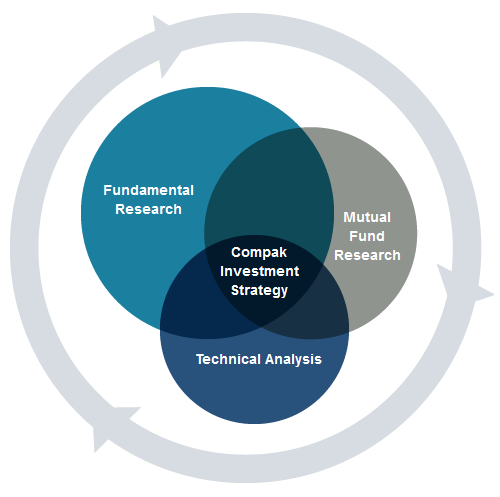

The Compak Research Advantage

Our research results are obtained from a combination of Fundamental research, Fund Research and Technical analysis.

Fundamental Research

Fundamental research involves a top-down analysis of global economic and market conditions. Apart from in-house research, Compak Asset Management utilizes the world class research resources of Goldman Sachs and J.P. Morgan for insight into markets. Fundamental analyses examine factors such as GDP growth, inflation, capital flows, interest rates, and currency movements, among other factors, to determine the risks and return opportunities of different sectors of the global economy. At Compak, fundamental research is used to determine the appropriate level of exposure to the markets and the sector diversification, both from an industry and geographical perspective.

Fund Research

Fund Research is required to determine appropriate mutual funds to invest in each asset class. Our fund selection model is based on a combination of Alpha generation capability, maximum drawdown analysis, standard deviation study and the momentum of net returns.

Technical Analysis

Technical analysis is the method of evaluating securities by analyzing statistics generated by market activity, past prices and volume. Compak President & Chief Investment Officer, Moe Ansari has been using technical analysis for over 35 years. Apart from investing in the right sectors and funds, positions have to be bought and sold at the appropriate time to generate maximum returns and control risk. Compak uses proprietary software that employs tools such as momentum analysis and Elliot Wave analysis to determine the appropriate buy and sell triggers for our positions.

Top-down Analysis of Global Economic and Market Conditions

| The Top Down Views | Implications for the Market |

|---|---|

| GDP | Top Line Sales & Profits; Sector/Industry Selection |

| Inflation | Pricing Power; Sector/Industry Selection |

| Debt Levels | Firm’s Financial Leverage |

| Capital Flows | Cost of Capital & Management’s Willingness to Take Risk. |

| Capacity | Cost Pressures & Operating Leverage |

| Banks Willingness to Lend | Financial Flexibility & Acquisitions |

| Asset Valuations | Returns on Capital & Balance Sheet Liquidity |

| Interest Rates | Debt Servicing Ability |

| Savings Rates | Consumer’s Ability & Willingness to Spend |

| Currencies | Profits from Foreign Competition |