Until a few years ago the life of the average family was relatively uncomplicated. People worked for the same company for most of their lives, lived a few years in retirement on Social Security and their pensions and passed modest estates on to their children. Increased longevity, changing demographics and a more complex and volatile financial world have changed all that. In addition to money management our clients are faced with multiple financial challenges that require specific steps to be taken for achievement of personal goals. That is what wealth management is all about, and in this changed environment, Compak Asset Management wants its clients to have access to some of the best advice, ideas and products.

Compak Asset Management is proud to offer its clients comprehensive personal financial planning by our Staff CERTIFIED FINANCIAL PLANNER professional as part of its wealth management process. While most firms charge a large sum of money for similar plans, Compak offers its clients this service at no additional cost. We believe that as our client, you deserve the best solution we can provide and we feel that creating and implementing a comprehensive plan will add tremendous value.

Today, a long-term plan is no longer a luxury but a necessity.

Consider the following facts:

- Most retirees today will live 25 years or more in retirement, requiring far in the way of financial management of resources to maintain a desired lifestyle. Social Security and company pensions will no longer provide the majority of retirement funds for many people.

- Tax law changes almost annually.

- Cost of college education for children has become a major financial challenge.

- The average American changes jobs seven times in a lifetime and millions of American are self-employed.

These challenges demand a new approach towards savings, retirement, taxes and estate planning.

Financial planning is usually an enlightening process.

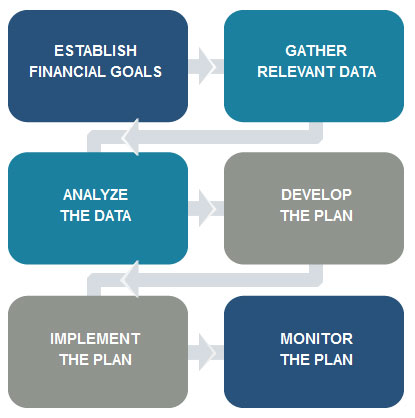

First, you will get together with your Compak Asset Management Advisor and one of our Certified Financial Planners to identify and prioritize your life goals. We will determine what is reasonable and realistic for your circumstances. The Advisor and CFP® will gather data, review your current cash flow, insurance policies and net worth and then assess your investments, retirement needs, taxes and estate plan. The Financial Plan usually addresses the following issues:

- Net Worth Planning

- Cash Flow Analysis

- Income Tax Planning

- Retirement Planning

- Probability Study (Monte Carlo)

- Estate Planning

With your goals and resources in mind, the financial planner can design a personalized financial approach that can best help you reach your goals. Once a comprehensive plan is developed, your Compak Advisor will work with you to implement appropriate strategies. This may include building an emergency fund, establishing a spending and savings plan, reviewing your investments for ensuring suitability of assets, purchasing disability or long-term care insurance, assisting you with creating a trust or developing a business succession plan.

Are you ready to start the Financial Planning Process? Click Here to begin.