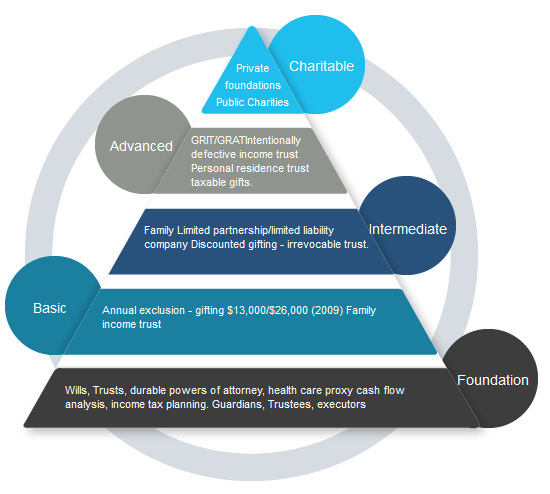

Five Levels of Estate Planning

The five levels of estate planning is a systematic approach for explaining in a way that you can easily follow. Which of the five levels you need to complete is based on your particular objetives and circumstances.

Elements of an Estate Plan:

- A will lets you specify your wishes, including how you want your property distributed, who will administer your estate and who will care for your minor children.

- A trust holds your assets for the benefit of one or more people (you, your spouse, your children). You’ll need an attorney’s assistance to create a trust.

- Powers of Attorney allow your chosen representative to act on your behalf for financial and health care decisions.

- Life insurance proceeds are paid to a beneficiary at your death.

- Gifts are transfers of property made during your life to family, friends, or charity.