Money Management

Compak attempts to construct a diversified portfolio using fundamental and technical research to find the best investments for each asset class. Compak uses multiple styles and asset classes to construct our clients’ portfolios. Portfolio models are rebalanced regularly to optimize return and/or reduce risk. Our attempt is to deliver maximum benefits of sector diversification, while also striving to deliver the benefit of superior asset selection by aligning with what we believe are the world’s best and brightest mutual fund managers.

Tactical Overlay

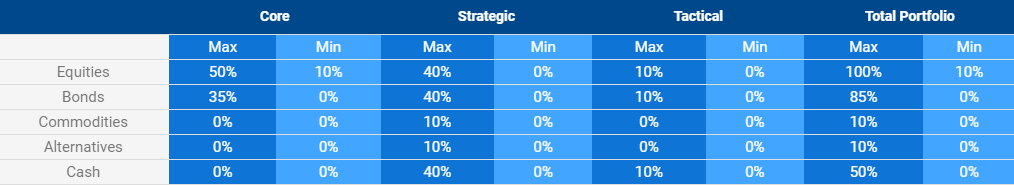

Tactical Asset Allocation is a Compak wealth management strategy aiming to increase and decrease the beta (market risk) in a portfolio. Tactical allocations may be in the form of cash, or indexed funds.

Strategic Asset Allocation

Strategic asset allocation is used as part of Compak’s wealth management strategy to gain access to areas of the market that the Compak investment team believes offer an attractive risk-return proposition. These market segments could provide good valuations or strong momentum.

Core Asset Allocation

Core asset allocation is the basic building block of Compak’s wealth management strategy of the portfolio. Some of these funds have displayed strong and consistent performance, and may be held for the long term.

Sample Asset Allocation Framework Driven by CAM’s Proprietary Technical and Fundamental Model*

Is your portfolio properly allocated? Click here to start the process for your optimized sample allocation.

Money Management

Compak Research Advantage

Customized Portfolios

*Your portfolio/allocation may be significantly different.